what is suta tax texas

² Experienced Nebraska and Rhode Island employers that are assessed the maximum unemployment tax rate are assigned a higher wage base. It is unlawful for employers to avoid a higher unemployment tax rate by altering their experience rating through transferring business operations to a successor.

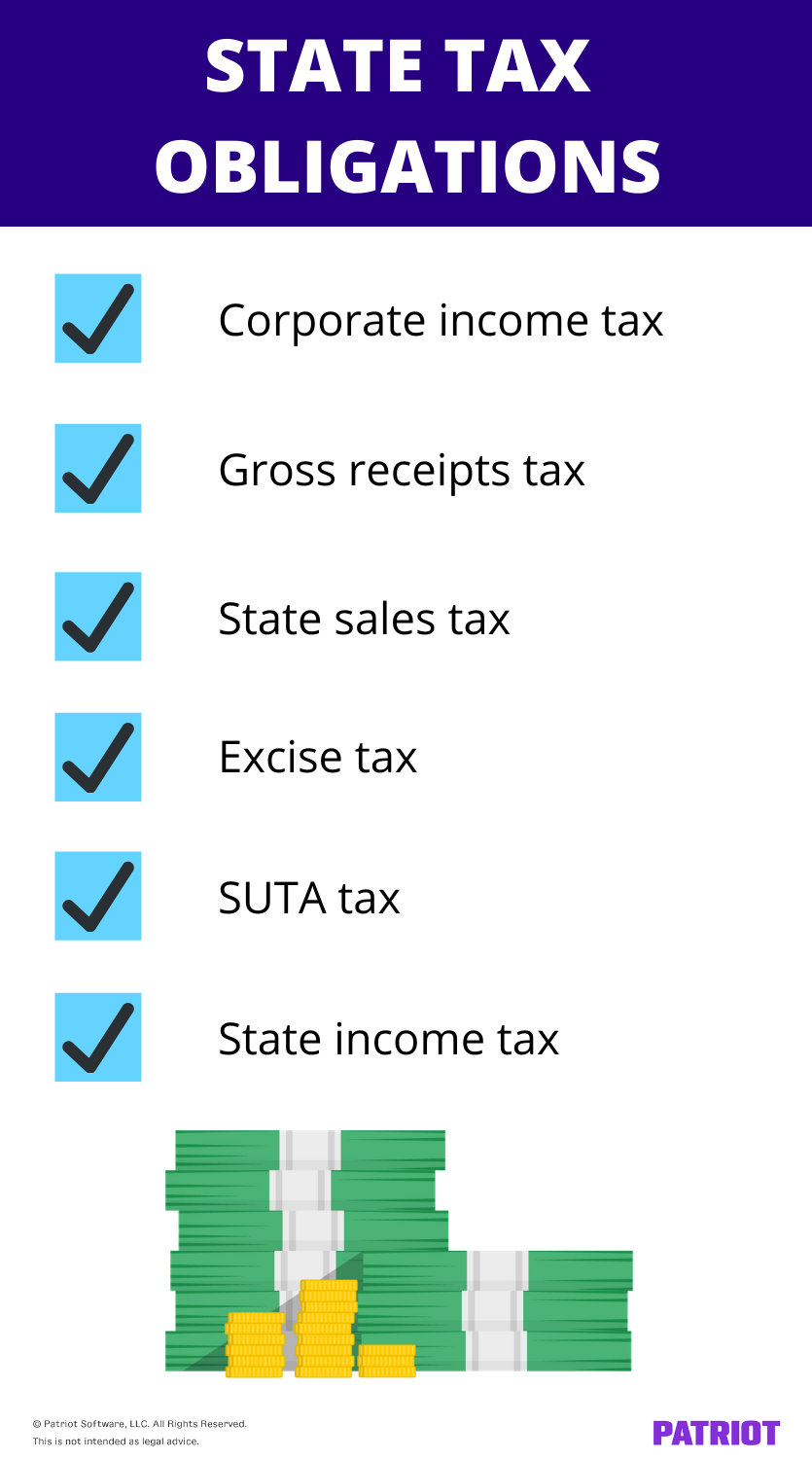

Business State Tax Obligations 6 Types Of State Taxes

SUTA dumping compromises experience rating systems by eliminating the incentive for employers to keep employees working and to return unemployment benefit.

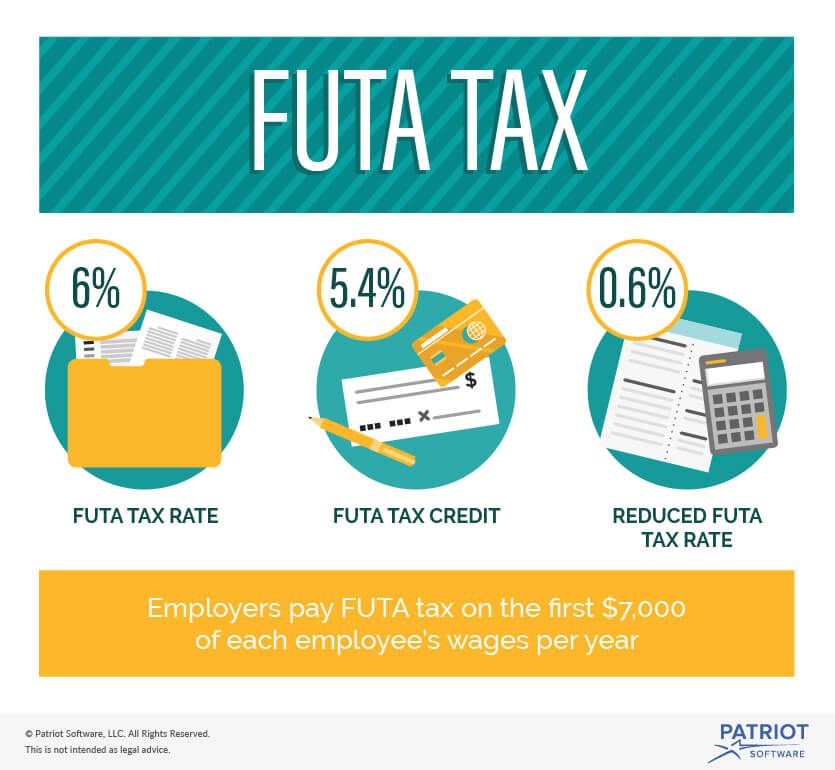

. However Virgin island employers must pay 24 to the government since this territory owes the US government money. According to the IRS if you paid wages subject to state unemployment tax you may receive a credit of up to 54 of FUTA taxable wages when you file your Form 940. Staying with the texas example the minmax tax rate for 2020 ranged from 031 to 631.

The FUTA tax rate is a flat 6 but is reduced to just 06 if its paid on time. The State Unemployment Tax Act known as SUTA is a payroll tax employers are required to pay on behalf of their employees to their state unemployment fund. SUTA was established to provide unemployment benefits to displaced workers.

Employers in California are subject to a SUTA rate between 15 and 62 and new non-construction businesses pay 34. An employers SUI rate is the sum of five components. This practice known as State Unemployment Tax Act SUTA dumping is a common scheme in which a business with a higher unemployment tax rate shuffles employees to another business in order to pay a lower.

Generally states have a range of unemployment tax rates for established employers. The 7000 is often referred to as the federal or FUTA wage base. File wage reports pay taxes more at Unemployment Tax Services.

52 rows SUTA the State Unemployment Tax Act is the state unemployment. SUTA State Unemployment Tax Act is a payroll tax paid by all employers at the state level. List of texas workforce commission county codes.

States use funds from SUTA tax to pay unemployment benefits to unemployed workers. What Is Suta Tax Texas. The FUTA and SUTA taxes are filed on Form 940 each year regardless if a business has an employee on unemployment insurance.

Some states require that both the employer and employee pay SUTA taxes. The State Unemployment Tax Act SUTA tax also called SUI state unemployment insurance or reemployment tax is a type of payroll tax that employers must pay to the state. What is the suta tax rate.

21 hours agoThe symptoms of monkeypox in humans can be similar to the symptoms of smallpox but the main difference is that monkeypox causes lymph nodes to swell the CDC says. What is SUTA. Your Effective Tax Rate for 2022 General Tax Rate GTR Replenishment Tax Rate RTR Obligation Assessment Rate OA Deficit Tax Rate DTR Employment and Training Investment Assessment ETIA Minimum Tax Rate for 2022 is 031 percent.

What is SUTA. See Experience Rating Method. What Is Suta Tax Texas.

For the majority of states SUTA tax is an employer-only tax. Employers report employee gross wages each quarter and pay taxes on the first 9000 per employee per year. The states SUTA wage base is 7000 per employee.

Use our free online service to file wage reports pay unemployment taxes view your unemployment tax account information eg statement of account chargeback details tax rate and adjust previously filed wage reports. However the money collected from the FUTA tax funds the federal governments oversight of each states individual unemployment insurance program. For example the SUTA tax rates in Texas range from 031 631 in 2022.

Maximum Tax Rate for 2022 is 631 percent. Your state will assign you a rate within this range. Are Dental Implants Tax Deductible In Ireland.

The State Unemployment Tax Act SUTA tax is a type of payroll tax that states require employers to pay. How APS Can Help. The state unemployment tax act known as suta is a payroll tax employers are required to pay on behalf of.

Since your business has. Newly liable employers begin with a predetermined tax rate set by the Texas UI law. States use funds to pay out unemployment insurance benefits to unemployed workers.

States might also refer to SUTA tax as the following. This practice known as state unemployment tax act suta dumping is a common scheme in which a business with a higher unemployment tax rate shuffles employees to another business in order to pay a lower rate. Most states send employers a new SUTA tax rate each year.

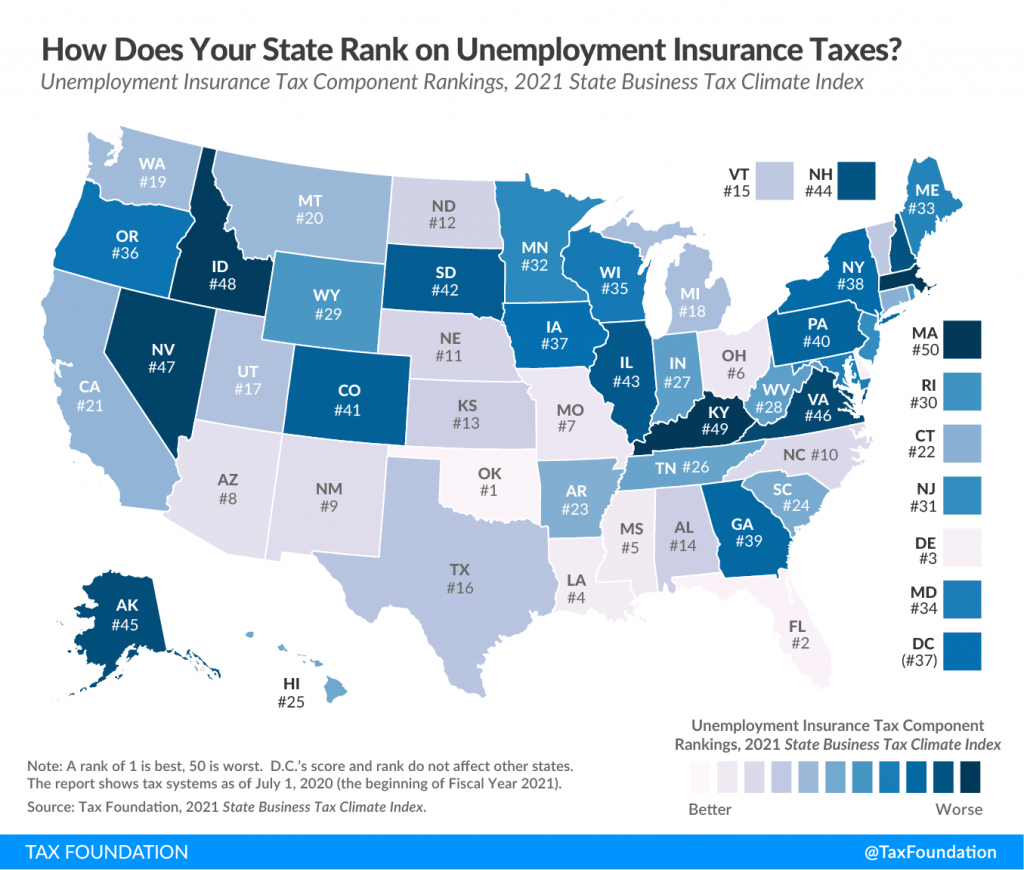

Income Tax Rate Indonesia. Each state establishes its own tax rate and wage base. Heres how APS system helps simplify SUTA management.

General Tax Rate Replenishment Tax Rate Unemployment Obligation Assessment Deficit Tax Rate and Employment and Training Investment Assessment. The incubation period or time. FUTA or Federal Unemployment Tax is a similar tax thats also paid by all employers.

These contributions provide monetary support to displaced workers. Opry Mills Breakfast Restaurants. Majestic Life Church Service Times.

SUTA is a tax paid by employers at the state level to fund their states unemployment insurance. The fund pays unemployment benefits to employees who have become unemployed at no fault of their own. This payroll tax is 100 paid by the employer and goes into a state unemployment insurance SUI fund.

Restaurants In Matthews Nc That Deliver. Restaurants In Erie County Lawsuit. The state unemployment tax act known as suta is a payroll tax employers are required to pay on behalf of their employees to their state unemployment fund.

File Wage Reports Pay Your Unemployment Taxes Online. To find the SUTA. Liable employers report employee wages and pay the unemployment tax based on state law under the Texas Unemployment Compensation Act TUCA.

SUTA stands for State Unemployment Tax Act. Employers engage in State Unemployment Tax Act SUTA dumping when they attempt to lower the amount of their unemployment insurance taxes by circumventing the experience rating system. The FUTA tax rate is 6 and applies to the first 7000 paid to each employee as wages during the year.

Wages are reported when they are paid rather than when they are earned or accrued. These taxes are put into the state unemployment fund and used by employees that lose their job through no fault of their own causing them to file for unemployment and collect their benefits.

What Is Sui State Unemployment Insurance Tax Ask Gusto

Breaking Down The Federal Unemployment Tax Act What Is It

How To Fill Out Irs Form 940 Futa Tax Return Youtube

Florida Payroll Software Payroll Software Payroll Florida

Calculating Futa And Suta Youtube

Futa Tax Overview How It Works How To Calculate

Are Employers Responsible For Paying Unemployment Taxes

Many Employers Face Higher State Unemployment Insurance Tax Costs Due To Covid 19

How To Reduce Your Clients Suta Tax Rate In 2014 Cpa Practice Advisor

2022 Federal Payroll Tax Rates Abacus Payroll

Sui Sit Employment Taxes Explained Emptech Com

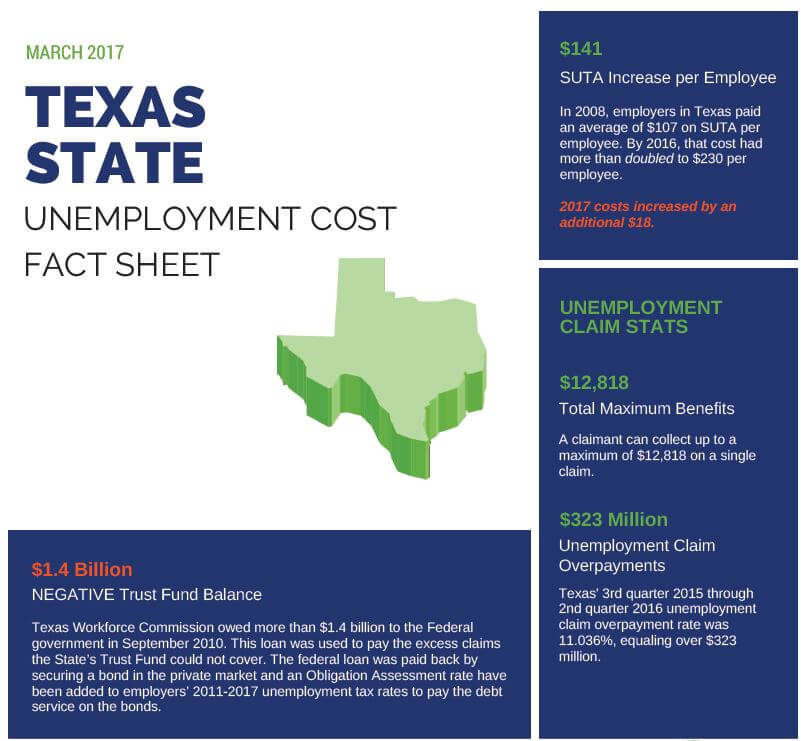

Texas Suta Increases Will Impact Employers What You Need To Know Nextep

How To Calculate Federal Unemployment Tax Futa In 2022

Fast Unemployment Cost Facts For Texas First Nonprofit Companies

Suta Tax Your Questions Answered Bench Accounting

Ultimate Guide To Sui And State Unemployment Tax Attendancebot